-

Discover Insurance Companies As Well As Their Functions In Economic Tasks

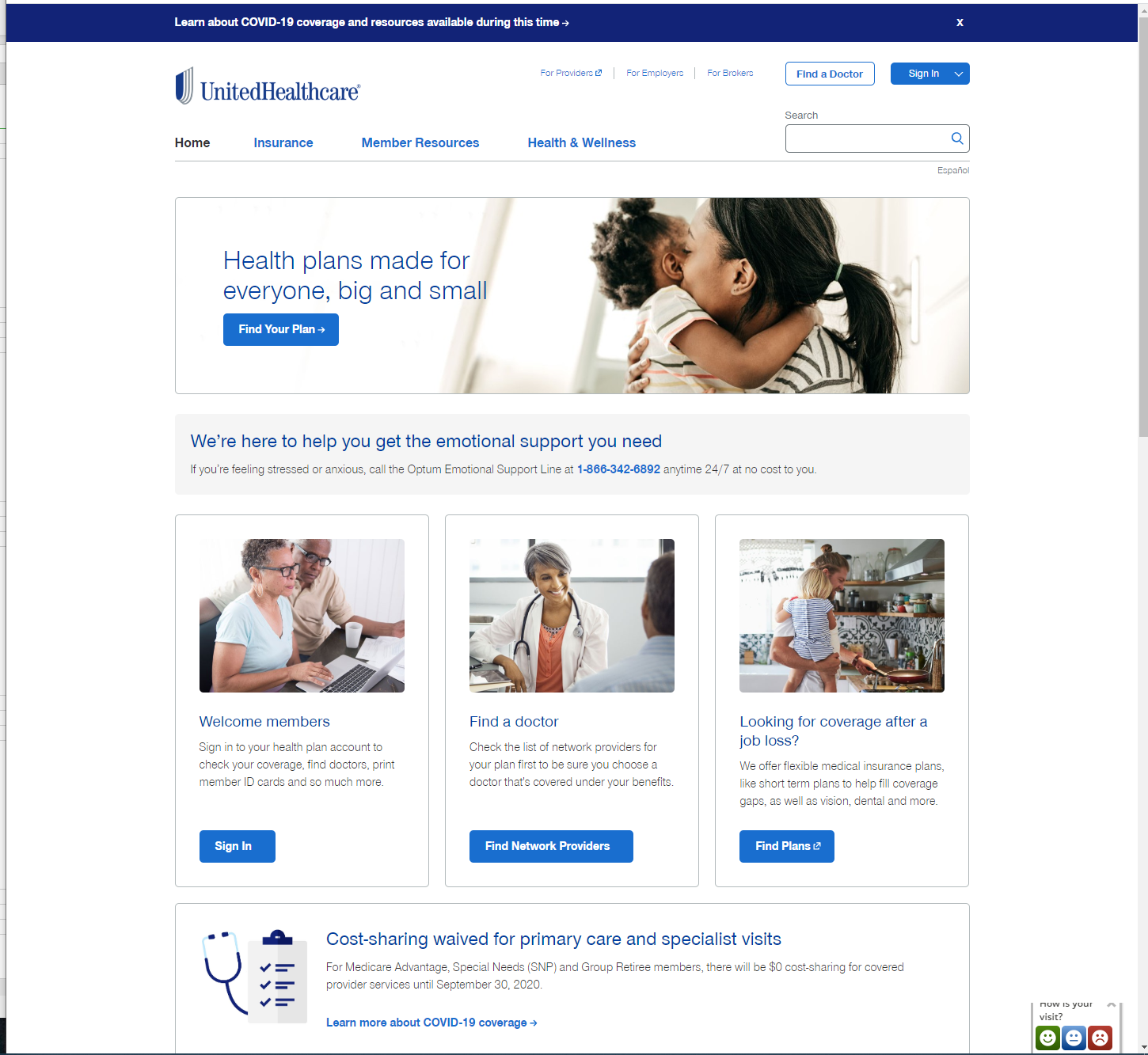

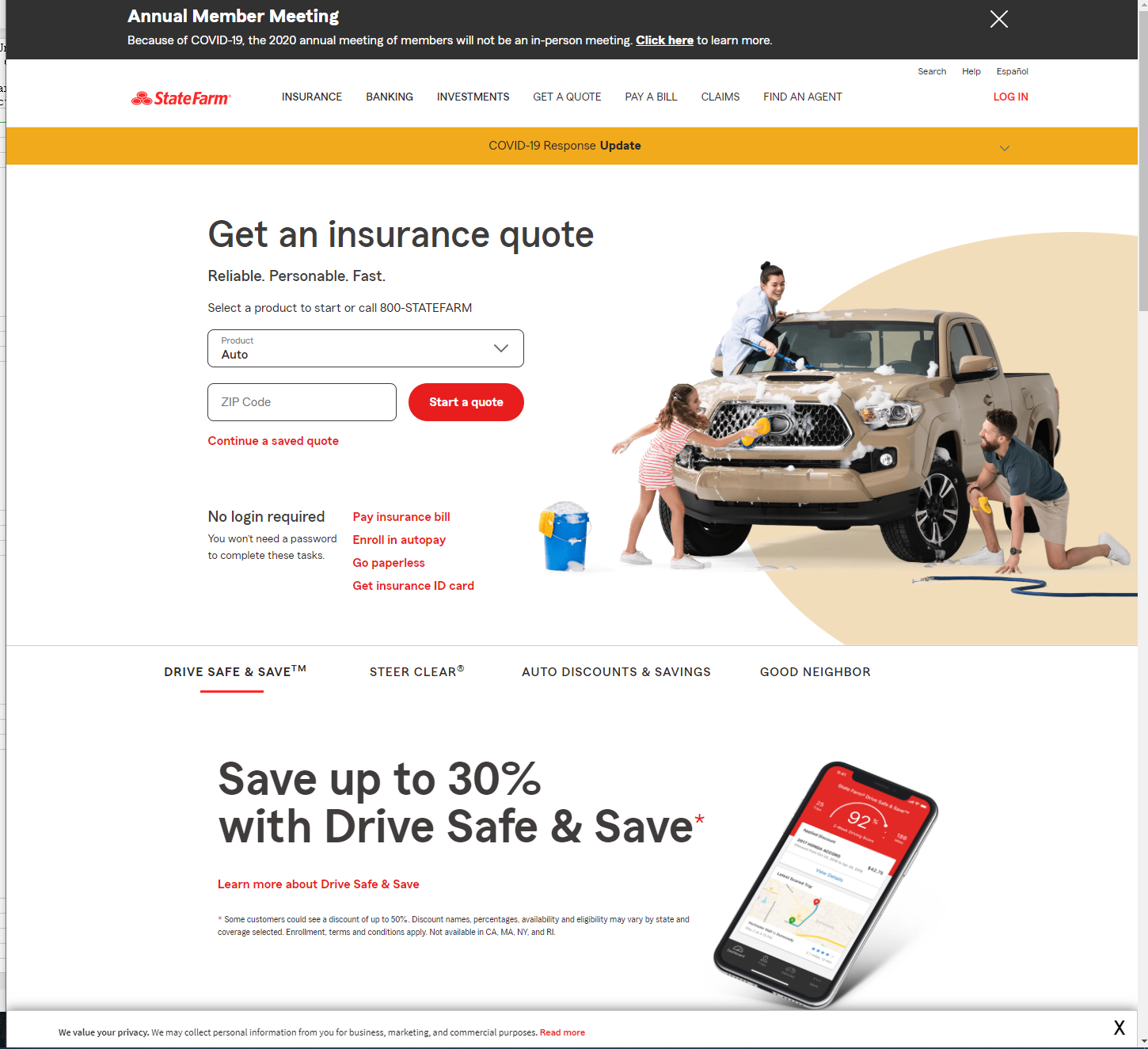

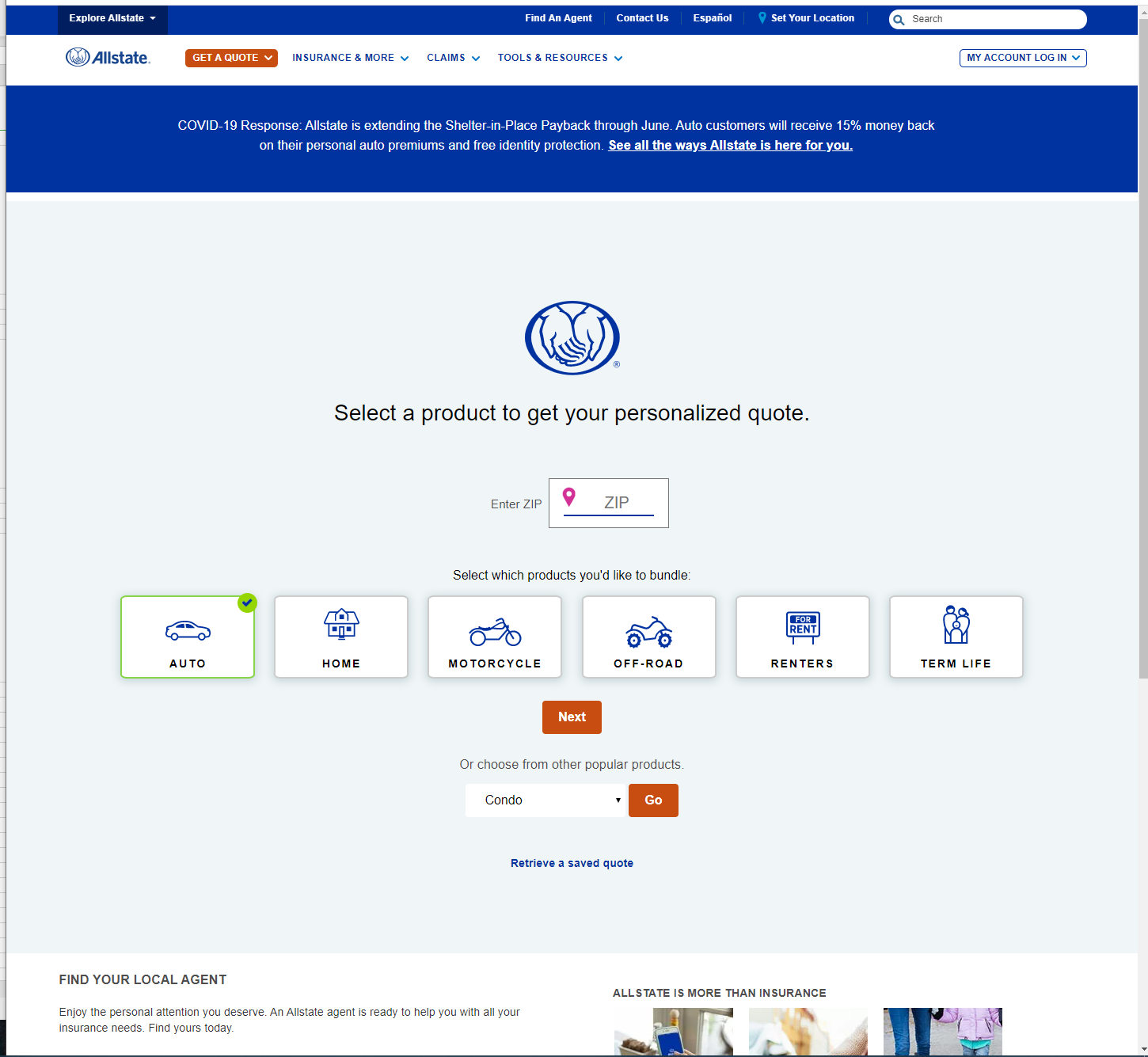

Insurer accomplish the feature of securing the physical honesty of the item or individual they protect. Its goal is easy; it helps protect all the financial risks that your insurance contract covers. This choice is available to everyone no matter their native land; each insurer functions likewise.

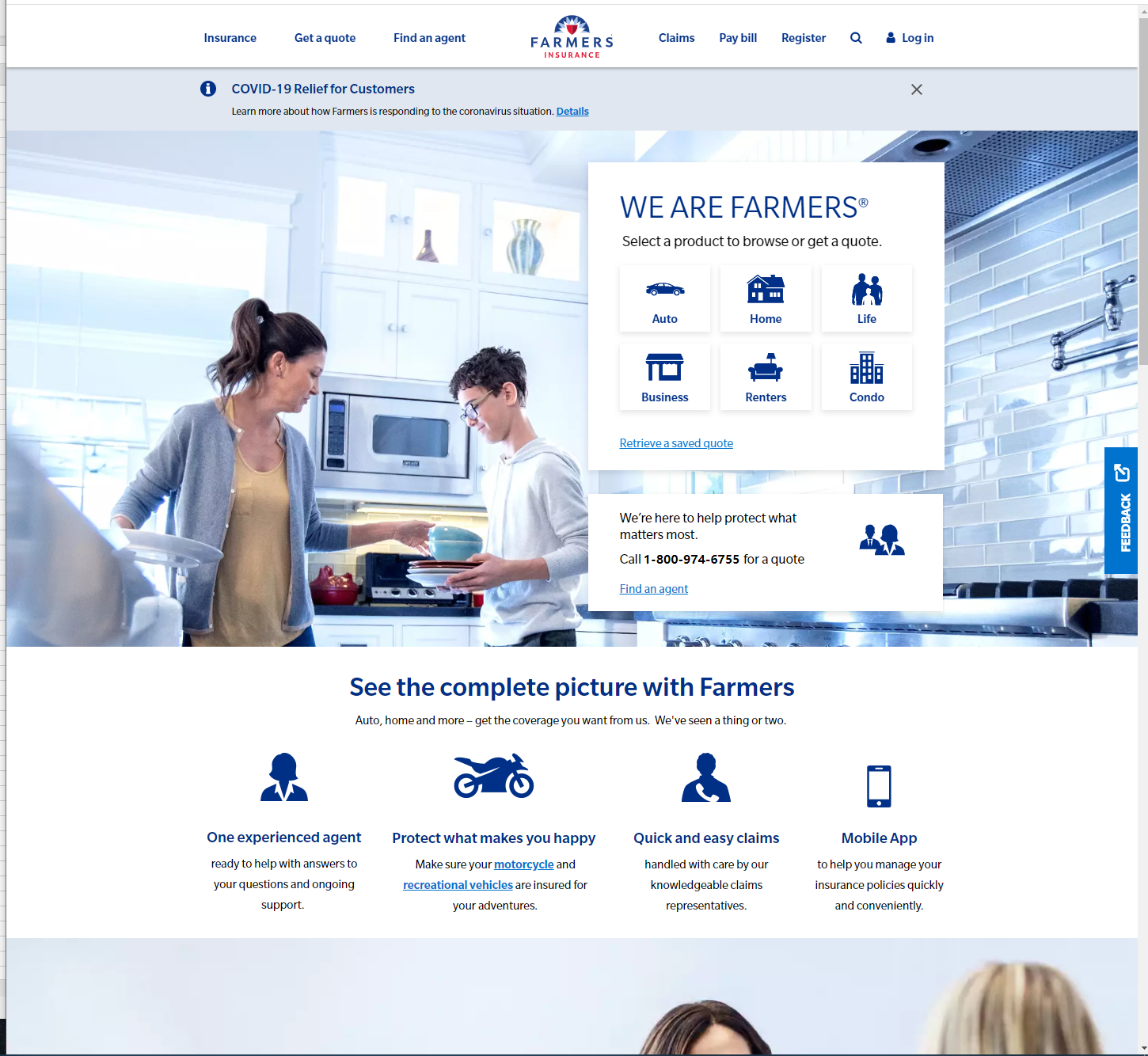

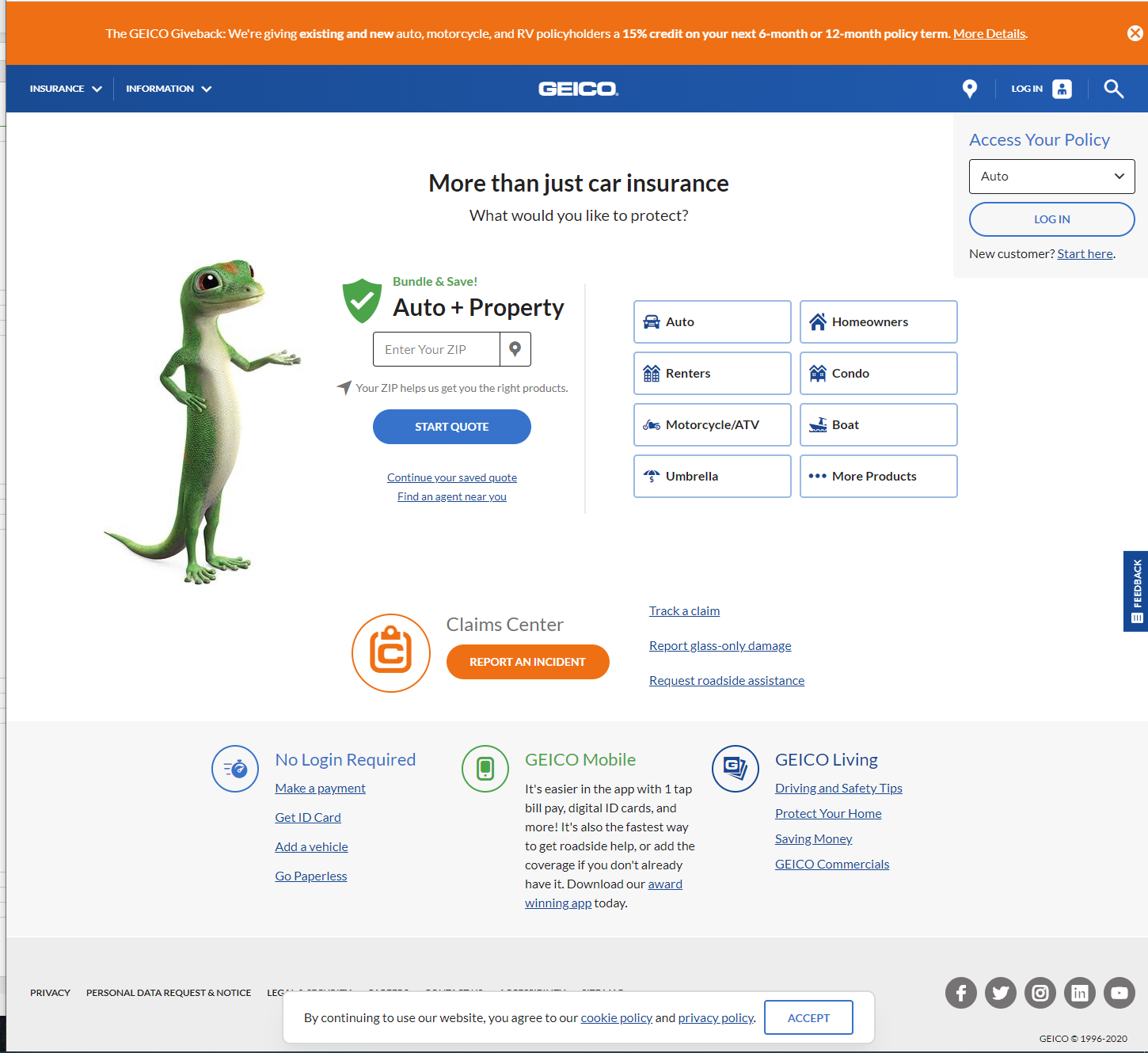

The benefit of insurer is that it safeguards all those damaged assets that were previously guaranteed. Automobiles, residences, or even individuals can buy insurance against threats of any kind of kind. Insurance shields virtually whatever that happens to your product or physical honesty; it enjoys to pay all those costs.

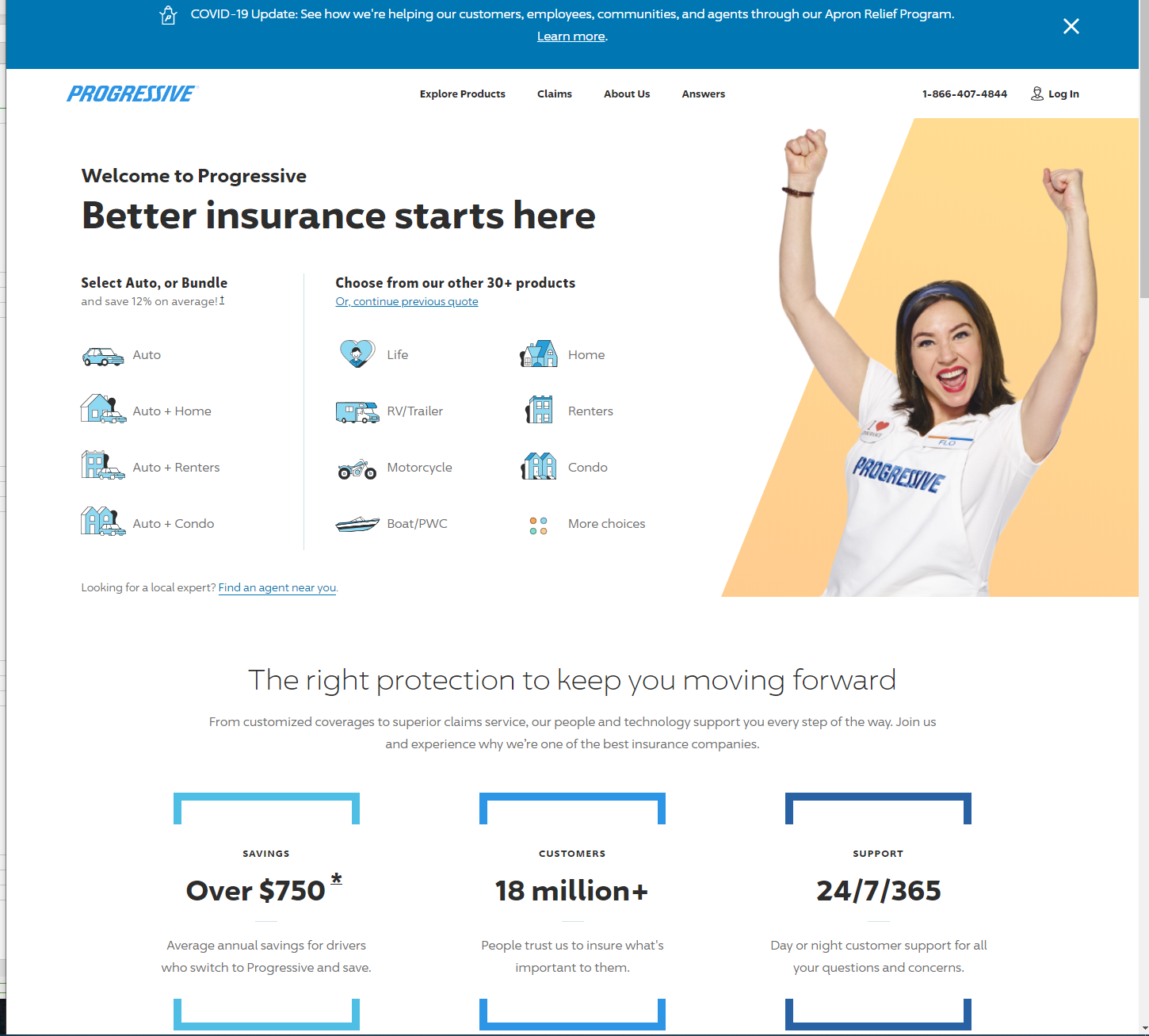

To enjoy the insurer, you need to first make a contract that specifies what sort of insurance you intend to obtain. The damages protection can be full or for some details risks or mishaps. The kind of repayment in the insurance company is periodical, and also its worth varies by each insurance company.

Many people pay full-risk insurance and never ever benefit from it while others do not have and also require it. It is much better to have threat insurance and not require it than to need it eventually as well as not have it.

Being protected is a good idea due to the fact that eventually, your physical honesty can be affected at the least predicted minute.

With life insurance policy, you will enjoy top quality healthcare when you may not have economic stability. Insurance will certainly cover your expenditures even after you die; lots of people choose this service instead of property or automobile. Real estate insurance is a fantastic choice to protect your home against fires, floods, as well as natural representatives that put it in danger.

What Is And also How Does The Insurance Agreement Job?

The insurance agreement is the agreement reached in between the insurance firm as well as the insurance policy holder where risk repayments are established. This agreement establishes certain fire protection legislations at a details level, low seriousness mishaps. The insurance policy holder or specialist should agree prior to providing that insurance plan that will certainly cover the concurred information.

You have to specify the complying with factors in the insurance policy:

- Name and also surname of the professional, current address.

- Dangers especially covered as well as the guarantees in the contract.

- List of products insured by real estate or vehicle contracts.

- Scope of insurance protection.

- Taxes.

- Costs due date and means you pay.

- Duration of the contract dated and also defined.

- If you have a mediator, you need to provide your name and also sources of the treatment.

With all these data, you have guarantees in your agreement, and also the insurer can give it to you without issues. Each factor must be extremely specific to make sure that both parties agree with the insurance coverage of the object or life insurance. The scope of insurance coverage will certainly identify if the damage falls within the contract or just how much it can secure it.

The insurance coverage can be handled by you or by third parties, such as an attorney or family member defining the cause. All life insurance policy papers should be with your approval to get the service when you die. The insurance amounts differ depending on what type of contract was submitted, including this:

- Life insurance or security of physical integrity.

- Interest insurance: items, thefts, fires.

- Required insurance: sporting activities, automobile.

- Various other insurance in the contract.

Learn About The Kinds Of Insurance

Among the kinds of insurance coverages are: for a specific property and also life insurance, observe them and also recognize all the regulations:

Item particularly:

- Fire insurance: the insurer will certainly award you compensation if your house catches fire or a details home experiences these material damages.

- Merchandise insurance: If an item is damaged in a movement or delivery of product, your insurance will make up for it.

- Theft insurance: the insurance provider takes on to shield your details residential property versus burglary.

Life insurances

- Physical honesty insurance: you will be made up if you suffer an impact or bruise that the insurer covers on an object. For instance, if your physical integrity is affected secretive transportation, the insurance firm will ensure your defense.

- Fatality insurance: all those impacted within the insurance agreement are compensated at the owner's desiccation. In general, numerous family members or recipients of the insurance usage it to cover funeral expenditures or do not accumulate compensation.

Various other insurance agreements:

- Sickness insurance: the contract will go through indemnification by the insured if he suffers from a details disease.

- Complete threat insurance: the agreement states all life, property, as well as car assurances, to name a few, that experience a risk that should be compensated.

- Traveling insurance: you will certainly be compensated for suffering from a specific accident throughout your trip.

- Orphan's insurance: it is provided to all those children under the age of 18 for the running out of 1 or both moms and dads.

- Accident insurance: you will certainly have payment for dealing with an accident within the firm or factor proposed in the agreement.

All insurance policy holders must specify the reason for acquiring the insurance contract. The indemnity will certainly cover the whole expense or a part as specified in the contract with the insurance firm.

Problems Stipulated By Insurance Companies

Insurers keep an order in each contract that they assign for their insurance companies or secured to supply warranties from both sides. It is a very financially rewarding company that will secure your life or item as long as you adhere to the regulations offered in the agreement. If you break the policies, your insurance will certainly not be approved, and also protection will not be offered to you.

Among the problems of the contract are:

- Specification of the contract to request, from the settlement of charges to the amount of compensation.

- To request compensation, you have to make sure that the plan covers these risks or damages to your object.

- The money will be sent to the insurance protégé or third party that you formerly included in the plan.

Various other problems within the agreement take value, yet these 3 are the most vital and must be born in mind. Insurer promote your security by recommending that you do not lure your life to accumulate the cash. Take the insurance plan as a bold device to shield yourself or your things at much less anticipated times.

To ask for settlement, you should speak with the insurance agent or boss of being the insurer's voice. The agent will certainly identify if its conditions put on the paid plan and indicate the actions to follow. In case of grievances, your insurance broker will give you with the required info to report the insurance firm.

Worldwide, the most asked for insurance policies are life insurance plans, as they supply fantastic capability after fatality. An additional frequently utilized is complete danger insurance, where different property as well as automobile elements are covered. Go with a trusted insurer that guarantees your policy, and also your repayments are attractive.